Full List of Resources

Travel Manual

Purpose: Guidance for faculty and staff regarding payment for travel expenses incurred for UNC Charlotte business purposes.

Contact Email: travel@charlotte.edu

Last Updated: August 8, 2024

Travel Reimbursements – Federal Subsistence Amounts, US State/Defense Department

Travel Reimbursements – Federal Subsistence Amounts

US Department of State – Offices of Allowances

Last Updated: September 5, 2019

Tuition, Housing, and Dining Appeal Form

Tuition, Housing, and Dining Appeal Form

Used to ask for a refund on tuition, housing, and dining fees and charges due to extenuating circumstances.

Last Updated: January 11, 2021

U.S. Department of State – Current Travel Alerts

U.S. Department of State – Current Travel Alerts

As a first step in planning any trip abroad, check the Travel Advisories for your intended destination. You can see the world at a glance on their color-coded map.

Last Updated: January 14, 2019

UNC Charlotte Form W-9 – Request for Taxpayer Identification Number with Certification

Purpose: This form is used to provide vendors with UNC Charlotte’s taxpayer identification number.

Last Updated: January 4, 2024

UNC Charlotte General Contract Terms and Conditions

Purpose: This document outlines the terms and conditions of general contracts.

Last Updated: November 10, 2023

UNC Charlotte Income Tax Status

Letter stating contributions to UNC Charlotte are tax deductible as a 501c3

Last Updated: November 13, 2014

UNC Charlotte Marriott Hotel & Conference Center Information

Hotel location and information

UNC Charlotte Marriott Hotel & Conference Center (Hotel) is located close to campus and offers many ways to partner with the University. Situated on approximately four-acres near the PORTAL Building, the Hotel is located at 9041 Robert D Snyder Road, Charlotte, NC 28262 and offers direct access to the LYNX Blue Line. For more information, call 704-978-8000 or visit Marriott.com.

Did you know that UNC Charlotte Marriott Hotel & Conference Center has…

- 226 guest rooms

- 5 suites including the 1,700 square foot Chancellor suite – the only room with an outdoor terrace

- Curated art program created by UNC Charlotte faculty, alumni and students

- More than 20,000 square feet of function space

- Largest space: 7,000 square foot Crown Room that can hold as many as 800 people (when at 100% capacity) for a stand-up reception

- More than 6,000 square feet of designed outdoor function space – the outdoor plaza has views of the UNC Charlotte campus

- All function space located on one level

- A full service restaurant, Golden Owl Tavern

How to book your next campus event

If a campus department desires to hold an event at the Hotel, the department contact should first consult with their department head or another appropriate manager to confirm approval and fund availability. Click on the summarized flowchart below for the complete procedures departments should use for scheduling campus events at the Hotel.

Click the image below to enlarge:

How to reserve a hotel room

- Reserve a Standard guest room on Marriott.com at the UNC Charlotte Business Rate by following the Hotel’s reservation procedures and hotel policies. Note that this rate only applies to individual travel for University guests traveling on University business.

- Email the completed information form to the Hotel via Sales@unccharlottemarriott.com.

- If applicable, complete the third-party authorization form for purchasing card (p-card) on file (this will be emailed separately).

Last Updated: July 1, 2024

UNC Charlotte Moving Expense Procedures

Overview

Moving expenses for new hires at UNC Charlotte can either be reimbursed using State funds or provided via an allowance using Discretionary funds. All moving support from the university is fully taxable to employees. Approval of the administrative head of the employing department is required prior to making commitments to pay moving and relocation expenses. Additional approvals may be required depending on the fund source, as described in these procedures.

ELIGIBILITY CRITERIA, FUNDING SOURCES AND ALLOWABLE AMOUNTS

Eligibility

The University may pay an employee’s moving expenses when (1) Moving reimbursement or allowances are available for full-time, permanent positions, and (2) eligible employees will be moving from outside a 100-mile radius of the Greater Charlotte area.

The employee’s move must be completed within the first year of employment. Exceptions require pre-approval, in writing, from the listed responsible individual (Senior Associate Provost for Faculty and the Executive Director of HR for Staff) before offering moving expense reimbursements or allowances to the prospective employee.

Funding Sources

The University offers two types of funds for employee moving expenses: 1) Moving reimbursements, covered by State funds, or 2) Moving allowances, covered by Discretionary funds. Only one of these two fund types may be used to pay for moving expenses for a single employee for either a reimbursement or allowance.

Moving Reimbursements (State Funds)

Typical “Moving-related expenses” covered via a moving reimbursement are outlined in detail in the North Carolina Office of State Budget and Management (OSBM) Budget Manual Sections 6.8 and 6.9 and include but are not limited to:

- Payment for movement of household and personal goods includes items such as furniture, clothing, and personal effects.

- Travel expenses incurred in moving the employee and his or her family from the old residence to the new residence are as follows:

- For locating a new residence, three (3) round trips, not exceeding six (6) days and three (3) nights, are required.

- For the day of moving – subsistence, lodging and mileage

The employee is required to submit a pre-approval request to use state funds, which requires the Chancellor’s approval. The moving reimbursement will require out-of-pocket expenses for the employee and will likely take more than one month to process.

Moving Allowances (Discretionary Funds)

Typical “Moving-related expenses” covered via a Moving Allowance include, but are not limited to, house hunting, moving truck rentals, hiring moving companies, shipping costs for household items and related supplies, storage costs before or during the move, shipping costs for household pets, mileage incurred during the move, and other move-related costs such as connecting/disconnecting utilities and temporary living arrangements.

- Typically, no supporting documentation or receipts are needed.

- However, when the allowance request is for $10,000 or more, receipts must be submitted and maintained, and the allowance will only cover the actual moving-related expenses supported by receipts.

Additional Fund Guidance

Payment for all moving-related expenses is the responsibility of the employee.

The moving expense reimbursement or allowance will be paid as a taxable lump sum payment and is intended to offset some of the employee’s moving-related costs at the hiring department’s discretion.

Departments may opt to cover applicable taxes for employees via a gross-up. Discretionary funds must be used for the gross-up portion of a reimbursement or allowance, regardless of the fund type used to cover moving expenses.

The Moving Expense Reimbursement and Allowance Forms are the only approved method for paying a moving reimbursement/allowance to an employee. Moving-related expenses cannot be paid directly to an employee or a vendor via p-card, 49er Mart, or Employee & Student Direct Pay Request (ESDPR).

Allowable Amounts

Departments can submit a total request up to the following amounts:

- Moving expense support is not considered “special pay subject to the “3/9ths” rule for 9-month faculty.

- Academic Affairs Budget provides the funding for faculty moving expenses for all colleges/departments except for the Belk College of Business (BCOB) and The Williams States Lee College of Engineering (COEN).

- Funding for staff moving expenses is contingent upon the availability of departmental funds. Note that while HR (Human Resources) approves moving expense reimbursements/allowances for staff they do not provide any central source of funding.

- For exceptions, include the following required information: Candidate’s Name; Rank and/or Title; Any additional working title (e.g., Distinguished Scholar); Department/College; Standard Amount of Moving Support for rank; Requested Exception Amount; Reason exception is needed.

Discontinuation of Employment

Employees that leave University employment prior to 90 days must reimburse the University 100% of any allowance received (gross, not net of taxes). Should an employee voluntarily leave University employment within one year of hire for a position other than a promotion within North Carolina state government, they may be required to reimburse the University for a prorated portion of the allowance. The employee should work with the hiring department to determine the amount to be repaid. No tax withholding or reporting adjustments will be made by the Payroll Office. Repayment should be made directly to the department outside of the payroll system.

Procedures

- If using State funds, your department or college’s business support staff should complete a Pre-approval Request Form (download it before completing it).

- You can share this instruction guide with new employees that walks them through the information that is needed for the pre-approval and reimbursement.

- Attachments should be uploaded as PDFs. Do not upload attachments as zip files.

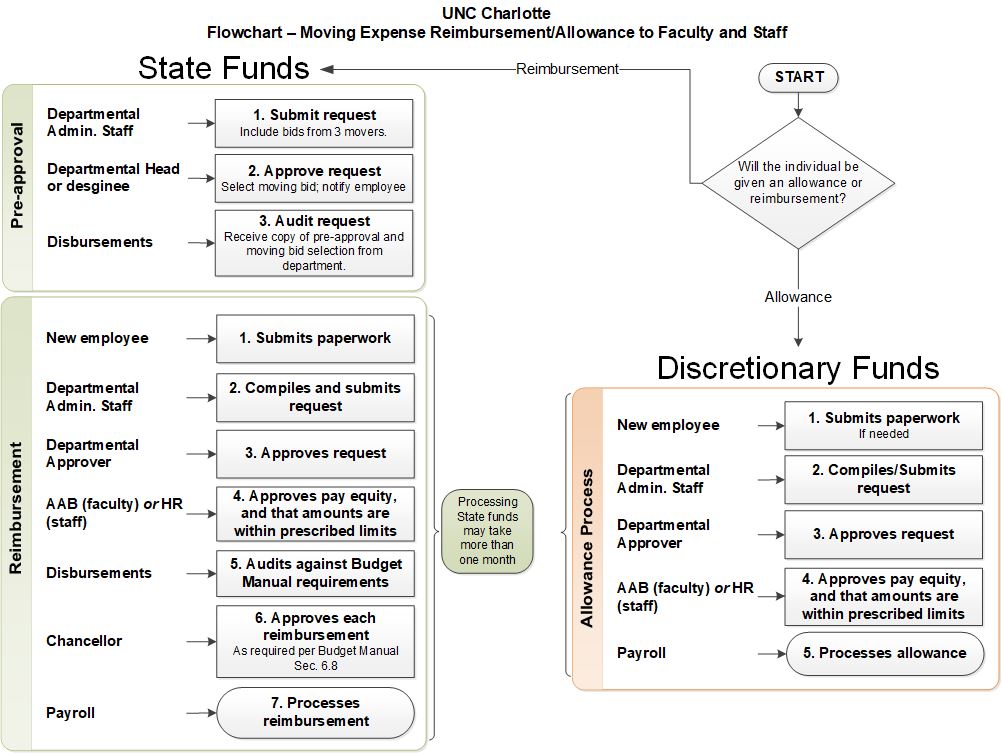

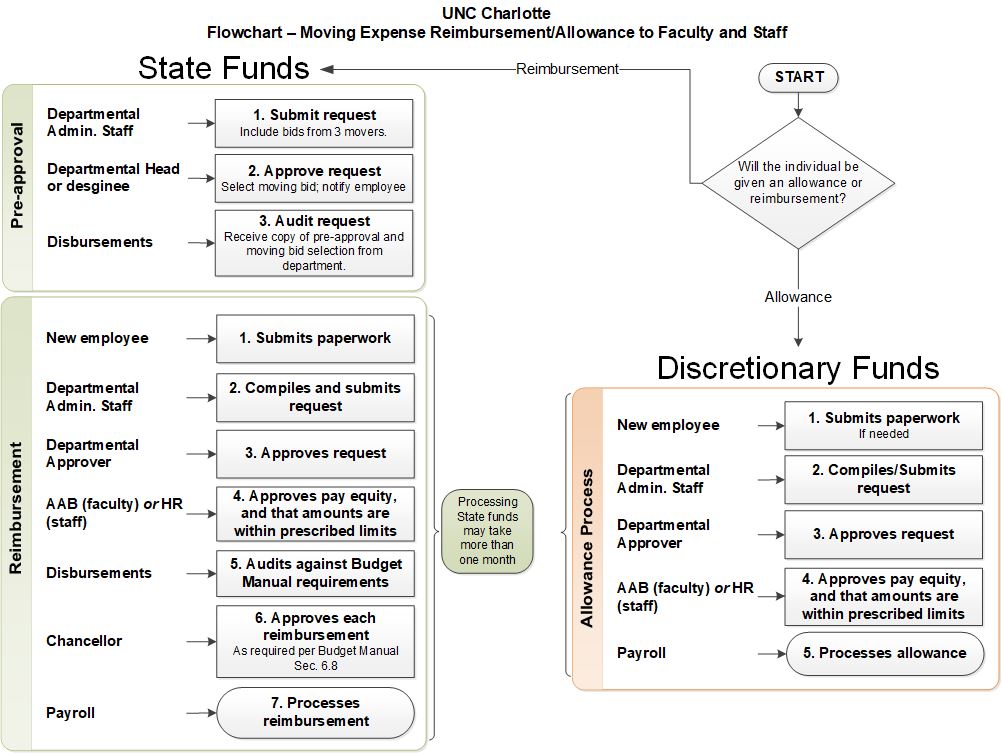

- New employees should NOT complete this form for themselves. The form and attachments follow an automated workflow for designated approvers, as detailed in the flowchart below:

Click the image below to enlarge:

Resources

Moving Expense Reimbursement Forms

- Moving Reimbursement Pre-Approval Request Form

- Moving Reimbursement Request Form

- Moving Allowance Request

Other resources

- OSBM Budget Manual Sections 6.8 and 6.9

- UNC Charlotte Moving Reimbursement Instruction Guide for new employees

Responsible Office: Controller’s Office

Contacts

- Faculty: Contact your College/Unit Business Officer

- Academic Affairs Budget: aa-budget@charlotte.edu

- Academic Affairs Personnel: aa-personnel@charlotte.edu

- Staff: Human Resources – Tiffani McCain, Director of Position and Performance Management, tmmccain2@charlotte.edu

- Financial Services

- Disbursements: travel@charlotte.edu

- Tax: taxoffice@charlotte.edu

- Payroll: PayrollDept@charlotte.edu

Created 2/18

Last Updated: May 1, 2024

Uniform Administrative Requirements for Federal Grants (Uniform Guidance 2 CFR 200)

Purpose: To provide requirements for financial management, monitoring and reporting for Federal funding.

Last Updated: January 12, 2023

University’s Cash Management Plan

North Carolina law, Chapter 147-86.10 of the General Statutes, requires that “all agencies, institutions, departments, bureaus, boards, commissions and officers of the State…shall devise techniques and procedures for the receipt, deposit, and disbursement of monies coming into their control and custody which are designed to maximize the interest-bearing investment of cash and to minimize idle and nonproductive cash balances.”

The University Controller has responsibility for developing and administering the Cash Management Plan in compliance with the Statewide Cash Management Plan, North Carolina General Statutes, and the State Treasurer. This Plan is maintained in the University Controller’s office for auditor review. The Internal Audit Office will periodically review cash management activities to ensure compliance with University policies and procedures. The State Auditor will annually determine if the University is in compliance with the Statewide Cash Management Plan.

The University’s Cash Management Plan most recently approved by the Office of State Controller (OSC) can be found above.

Last Updated: March 25, 2024

UP 602.11 Appendix B – Reportable Gifts, Awards, & Prizes Form

Purpose: Use this form to document employee and non-employee gifts, awards, and prizes that are reportable to the Tax Office (Reese Building 327). This criteria is defined in Policy 602.11

Last Updated: January 11, 2021

UP 602.11 Appendix C – Gifts, Awards, & Prizes Log Sheet

Purpose: This form is recommended for departmental use to log non-reportable gifts, awards, and prizes (non-reportable to the Tax Office; see criteria in Policy 602.11, Sect. IV. See Appendix A for thresholds for reportable gifts, awards, and prizes).

Last Updated: January 11, 2021

Vendor Forms

Vendor Forms

Follow the supplier instructions to search for a supplier, request a new supplier and update an existing supplier in 49er Mart.

Contact Email: VendorRelations@uncc.edu

Last Updated: October 5, 2021

Waiver of Competition Justification

Purpose: Use this form to request a waiver for competition.

Last Updated: June 29, 2021

Wire Transfer FTR

This Financial Transaction Request (FTR) eForm should be used to wire payments from the university when a check or ACH payment is not possible or when sending in foreign currency. For instructions on how to complete this form, see How to Pay Vendors with Outgoing Wire Transfers

Last Updated: January 11, 2021